center for responsible lending payday loans

Consumer Advocates Respond to. Center for Responsible Lending 3 The high level of payday loan churnwhen borrowers either directly renew loans or pay back a loan but take out another shortly thereafterunderscores the existence of a long-term debt trap.

Visualizing The State Of Lending Center For Responsible Lending

The Sandlers helped found and are among the largest benefactors of the Center for Responsible Lending a nonprofit nonpartisan organization fighting predatory mortgage lending payday loans and other products that prey on consumers.

. District of Columbia Office 910 17th Street NW Suite 800 Washington DC 20006 202 349-1850. Research from the Center for Responsible Lending CRL reported that payday lenders drained more than a half billion dollars in five years from the state and in 2016 alone payday lenders cost Michigan. Our focus is on consumer lending including home loans payday loans credit cards bank overdrafts.

Primarily mortgages payday loans credit cards bank overdrafts and auto loans. Primarily mortgages payday loans credit cards bank overdrafts and auto loans. District of Columbia Office 910 17th Street NW Suite 800 Washington DC 20006 202 349-1850.

Center for Responsible Lending 302 West Main Street Durham NC 27701 919 313-8500. ProPublica an investigative reporting newsroom. Michael Calhoun president Martin Eakes CEO Products.

The fees on the loans average around 369 APR. Our focus is on consumer lending. California Office 1970 Broadway Suite 350 Oakland CA 94612 510 379-5500.

Was pushing CFPB to support its own small-dollar loan product with a much lower interest rate as an alternative to payday loans. Our focus is on consumer lending. Wealth-stripping payday loans trouble communities of color.

Our focus is on consumer lending. Center for Responsible Lending 302 West Main Street Durham NC 27701 919 313-8500. Center for Responsible Lending 302 West Main Street Durham NC 27701 919 313-8500.

The Center for Responsible Lending is a nonprofit non-partisan organization that works to protect homeownership and family wealth by fighting predatory lending practices. The Center for Responsible Lending a Self-Help affiliate is a national nonprofit nonpartisan research and policy organization. CRL is dedicated to protecting homeownership and family wealth by working to eliminate abusive financial practices.

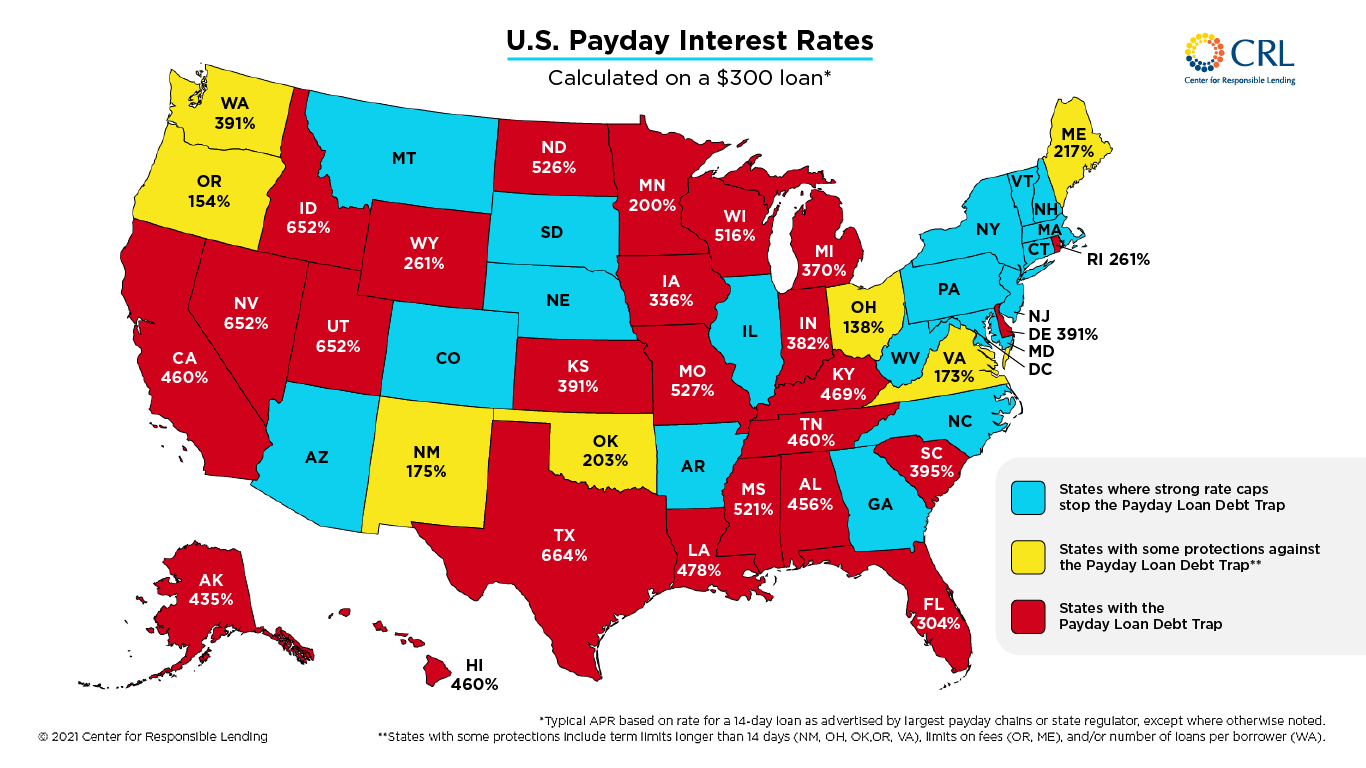

Center for Responsible Lending 1907 followers on LinkedIn. Download this color-coded map to explore which states have implemented rate caps to stop the payday loan debt trap and where the rest of the other states fall within the debt trap of payday. District of Columbia Office 910 17th Street NW Suite.

The Center for American Progress a progressive think tank. A typical payday loan in Texas for example comes with a 661 interest rate according to the Center for Responsible Lending. The Center for Responsible Lending CRL is a non-partisan research and policy group working to ensure our nations consumer finance system promotes and protects homeownership and family wealth.

California Office 1970 Broadway Suite 350 Oakland CA 94612 510 379-5500. District of Columbia Office 910 17th Street NW Suite 800 Washington DC 20006. Center for Responsible Lending 302 West Main Street Durham NC 27701 919 313-8500.

In Oregon the interest rate is 154. The Center for Responsible Lending CRL published Phantom Demand Parrish King 2009 which. The Center for Responsible Lending is a nonprofit non-partisan organization that works to protect homeownership and family wealth by fighting predatory lending practices.

In Michigan payday loans are typically two weeks in duration and may be up to 600. Primarily mortgages payday loans credit cards bank overdrafts and. Center for Responsible Lending.

To help consumers put these recent changes into perspective the Center for Responsible Lending analyzed the average APR for a 300 loan in.

Center For Responsible Lending Linkedin

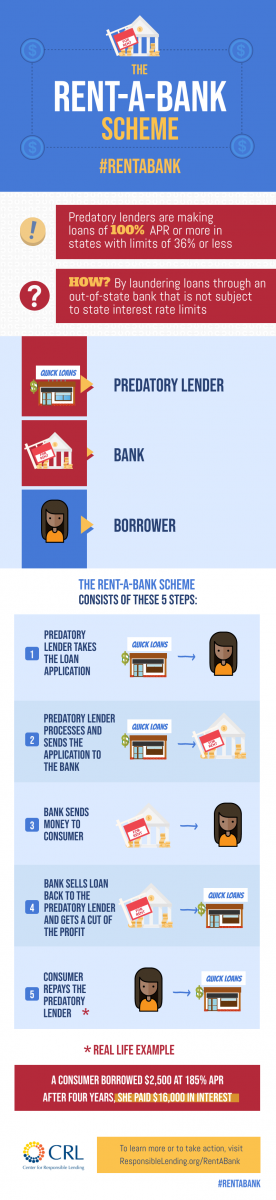

The Rent A Bank Scheme Center For Responsible Lending

Center For Responsible Lending Linkedin

/Pay-Day-Loan-Personal-Loan-dfdeaa22f6ea4790b1c966fcd6c937cf.jpg)

Payday Loans Vs Personal Loans What S The Difference

Google Is Banning Payday Loan Ads National Globalnews Ca

As Clock Starts For Comments On Gutting Of Cfpb Payday Rule New Map Shows Triple Digit Interest Rates Across America Center For Responsible Lending

Center For Responsible Lending Announces New Logo Center For Responsible Lending

3 Payday Loan Alternatives Employers Can Offer Workers Everee

Payday Loans Cost Economy 1 Billion In 2011 Study

Advocates Submit Letter To Fdic To Stop Banks From Fronting For Predatory Lenders Ncrc

Map Of U S Payday Interest Rates Center For Responsible Lending

Tywkiwdbi Tai Wiki Widbee The Tragedy Of Payday Loans

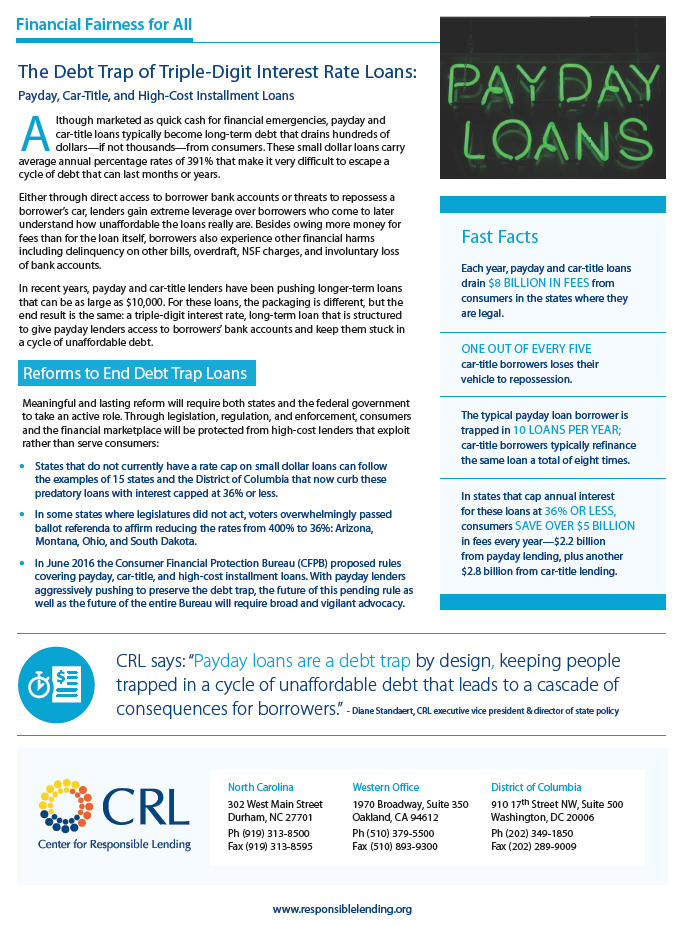

The Debt Trap Of Triple Digit Interest Rate Loans Payday Car Title And High Cost Installment Loans Center For Responsible Lending

Credit Builders Alliance Cba On Twitter 80 Of Borrowers Have To Take Out Another Payday Loan To Repay The Original Loan Initiating A Debt Trap Cycle The Vcfca Would Stop This Debt

The Payday Lending Trap Center For American Progress

Study Finds Strong Continuing Support For South Dakota S Capping Consumer Loan Rates At 36 Interest

Payday Lending Is Big Business What You Should Know

Center For Responsible Lending Linkedin

How Small Dollar Lending Flexible Pay Could Challenge The Inequity In Payday Lending